Why not go back to the good times?

With all of the fiscal cliff noise, I hear a lot of chest beating about how our economy thrived under Bill Clinton. I agree. But just saying Clinton was a democrat and therefore his policies and Obama's policies must be the same is a pretty lazy and incorrect assumption. Hear are some words from former Clinton labor secretary Robert Reich's blog blasting Republican's for not wanting to raise top tax rates:

"Funny, I don’t remember the economy suffering under Bill Clinton’s taxes...I seem to recall that the economy generated 22 million net new jobs during those years, unemployment fell dramatically, almost everyone’s income grew, poverty dropped, and the economy soared. In fact, it was the strongest and best economy we’ve had in anyone’s memory."

Reich is correct on one account. Under Clinton things went very well for growth, jobs, and debt. If we think Willie's years were great, then lets be clear on ALL of the conditions going on in the 1990s, not just the few that fit the self serving argument.

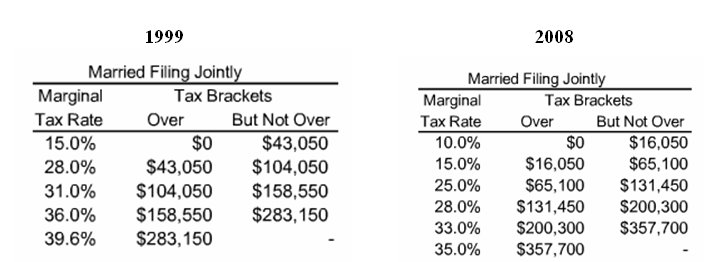

First, tax rates were higher for EVERYONE, not just rich people:

Quite simply, if you want to go back to the 1990s from a tax rate side, you need to let ALL of the tax cuts expire which will raise taxes on ALL income groups. I do not understand the liberal stance on this issue. Dems keep saying that the rich need to go back to paying their "fair share" like under Clinton, but why do they not want to let all the tax cuts expire. Just like Reich points out, the economy did not suffer under Clinton tax rates, right? Anyone want to wager on what economic growth does if all the tax cuts expire? If you truly are a believer in the higher tax philosophy, I would think you want all the rates to go up so you can prove that the economy and tax rates are wholly unrelated.

Second, Under Clinton average government spending was 19.4% of GDP. Under Obama Spending has averaged 23.8% of GDP and his future budgets suggest he never intends to bring this below 22% of GDP. In order to get spending back to Clinton days, Obama would have to immediately cut spending by $600B PER YEAR. His latest "proposal" called for about $160B in annualized cuts (with little to none of that in the next few years).

Source: http://www.factcheck.org/2010/07/geithners-gdp-whopper/

Third, capital gains taxes were CUT under Clinton from 28% to 20% in 1997. This helped lead to a boom in federal revenue as the stock market soared. Obama is suggesting increasing the cap gains and dividend tax rates moving the exact opposite way of Clinton.

Fourth, Clinton reformed welfare reducing the cost to taxpayers. Obama is adding Obama-care with all of its taxes and penalties to the backs of workers and businesses.

Bottom line, in order to get to a Clintonian Utopia, Obama would need to repeal Obama-care, massively reduce federal spending, and cut taxes on capital while raising taxes on all income groups (and probably would need to create a tech boom as well). Obama does not have the stomach for any of that. Please do not equate Obama to Clinton just because he wants to raise taxes on the top 2%. His policies are absolutely NOTHING like the policies of the '90s. Again do more than just read headlines and one-liners, look at the info for yourself.

Lets be clear, nobody actually believes raising taxes will cause economic growth, but more importantly we have little evidence raising tax rates increases tax revenues or reduces debt. The only reason for raising taxes on 2% of the population is political as doing so makes people feel better that the rich are paying their 'fair share'. As illustrated below, the rich already pay a much higher portion of total taxes and their tax rates are higher relative to their incomes. So fairness is explained by going back to the 90s rates. Except, if that is fair, do they not have to raise rates on everyone?

With all of the fiscal cliff noise, I hear a lot of chest beating about how our economy thrived under Bill Clinton. I agree. But just saying Clinton was a democrat and therefore his policies and Obama's policies must be the same is a pretty lazy and incorrect assumption. Hear are some words from former Clinton labor secretary Robert Reich's blog blasting Republican's for not wanting to raise top tax rates:

"Funny, I don’t remember the economy suffering under Bill Clinton’s taxes...I seem to recall that the economy generated 22 million net new jobs during those years, unemployment fell dramatically, almost everyone’s income grew, poverty dropped, and the economy soared. In fact, it was the strongest and best economy we’ve had in anyone’s memory."

Reich is correct on one account. Under Clinton things went very well for growth, jobs, and debt. If we think Willie's years were great, then lets be clear on ALL of the conditions going on in the 1990s, not just the few that fit the self serving argument.

First, tax rates were higher for EVERYONE, not just rich people:

|

| Clinton Rates (left) v Bush Rates (right) |

Quite simply, if you want to go back to the 1990s from a tax rate side, you need to let ALL of the tax cuts expire which will raise taxes on ALL income groups. I do not understand the liberal stance on this issue. Dems keep saying that the rich need to go back to paying their "fair share" like under Clinton, but why do they not want to let all the tax cuts expire. Just like Reich points out, the economy did not suffer under Clinton tax rates, right? Anyone want to wager on what economic growth does if all the tax cuts expire? If you truly are a believer in the higher tax philosophy, I would think you want all the rates to go up so you can prove that the economy and tax rates are wholly unrelated.

Second, Under Clinton average government spending was 19.4% of GDP. Under Obama Spending has averaged 23.8% of GDP and his future budgets suggest he never intends to bring this below 22% of GDP. In order to get spending back to Clinton days, Obama would have to immediately cut spending by $600B PER YEAR. His latest "proposal" called for about $160B in annualized cuts (with little to none of that in the next few years).

Source: http://www.factcheck.org/2010/07/geithners-gdp-whopper/

Third, capital gains taxes were CUT under Clinton from 28% to 20% in 1997. This helped lead to a boom in federal revenue as the stock market soared. Obama is suggesting increasing the cap gains and dividend tax rates moving the exact opposite way of Clinton.

Fourth, Clinton reformed welfare reducing the cost to taxpayers. Obama is adding Obama-care with all of its taxes and penalties to the backs of workers and businesses.

Bottom line, in order to get to a Clintonian Utopia, Obama would need to repeal Obama-care, massively reduce federal spending, and cut taxes on capital while raising taxes on all income groups (and probably would need to create a tech boom as well). Obama does not have the stomach for any of that. Please do not equate Obama to Clinton just because he wants to raise taxes on the top 2%. His policies are absolutely NOTHING like the policies of the '90s. Again do more than just read headlines and one-liners, look at the info for yourself.

Lets be clear, nobody actually believes raising taxes will cause economic growth, but more importantly we have little evidence raising tax rates increases tax revenues or reduces debt. The only reason for raising taxes on 2% of the population is political as doing so makes people feel better that the rich are paying their 'fair share'. As illustrated below, the rich already pay a much higher portion of total taxes and their tax rates are higher relative to their incomes. So fairness is explained by going back to the 90s rates. Except, if that is fair, do they not have to raise rates on everyone?