Time to ride the bull?

Despite my best efforts to look for silver linings, my blogs tend to feel negative, because I generally disagree with the policies and philosophies being implemented (higher taxes, Obama-care, etc...). However, I wanted to spend some time pointing out very positive signs for our economic prospects to highlight hopes of better economic times around the corner:

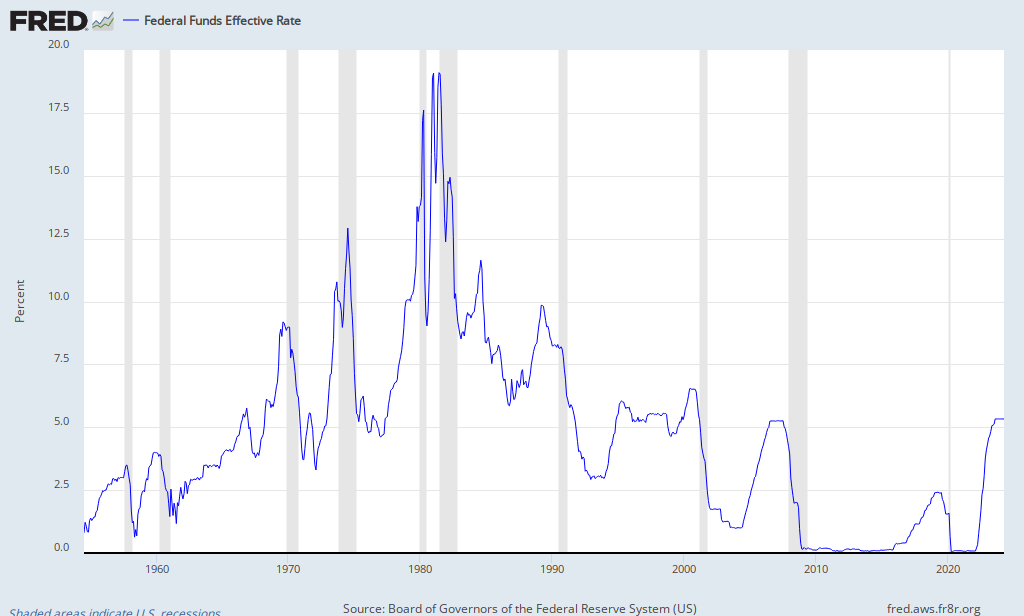

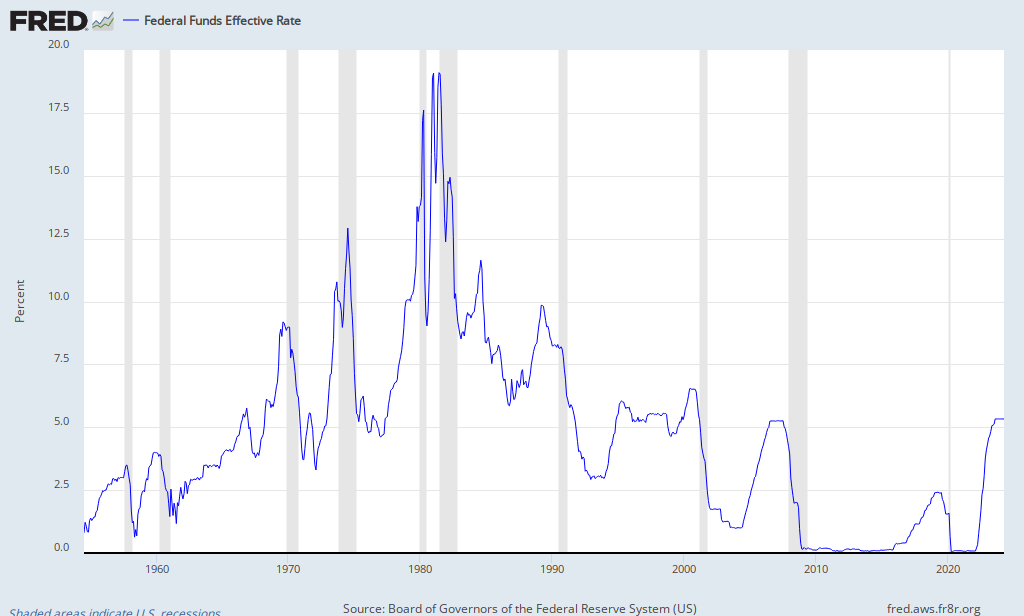

1) Interest Rates will remain low. Low interest rates encourage investment and spending which is a major plus to economic growth, but also tends to induce inflation which of course can be an economic nightmare. You may think the Federal Reserve pushing interest rates to virtually zero for three years and counting would trigger inflation...

However, as you can see below, inflation has been quite tame (anything below 0.25% for core CPI is ok):

Further, as many of you probably have experienced, wage inflation is very low, meaning that production costs remain cheap and that transfers to lower prices for goods and services.

Wage inflation is low for a bad reason, unemployment is horribly high, but the flip side is that due to high unemployment we have a long way to improve before we start to feel wage inflation in our products and services.

Finally, the rest of world is in really bad shape financially, and are reacting by printing money to boost exports and bailout governments. When they devalue their currency thru money printing our currency's relative value rises, and that stronger dollar translates into cheaper imports which tamps down inflation further.

All of this to say that inflation is low and appears to be capable of staying low for the foreseeable future, and thus borrowing and spending have room to expand.

2) Oil/Gas Production is Booming. Thanks to shale oil we are hitting oil production levels not seen since the early '90s.

Further, Natural gas production is up 20% over the last 5 years:

Both of these things have the effects of keeping energy costs lower for both homes and businesses, but also have the added benefits of both raising GDP, creating jobs, and even lowering government defecits through high tax revenues.

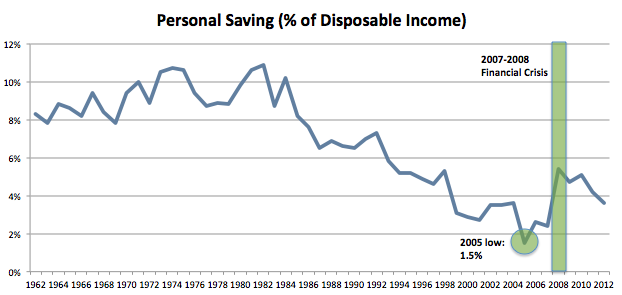

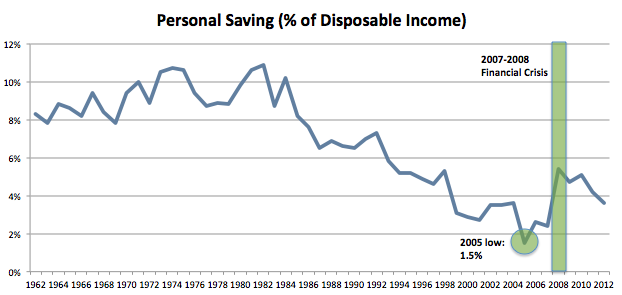

3) Savings is on the rise. While the federal government has been burning through dollars at a record pace. Companies, Families and Local Governments have been cutting the fat and saving money. Personal savings rates are at mid-90s levels and corporate cash is at all time highs:

Source: nerdwallet.com

Remember savings is just future spending and thus more savings from these entities will allow for more economic activity down the line.

My point to all of this, low interest rates, increasing oil production, higher savings levels all point to strong support for a good economic growth. We still have massive headwinds with the looming health care law, the reckless inability of the federal government to shrink long term entitlement spending, and states and municipalities like California, Illinois, and Detroit all deteriorating under the weight of their spending obligations (there's that negativity). However, we also have taken tax uncertainty off the table and have begun to ever so slightly cut federal spending with the Sequester. So possibly some of the the uncertainty created by the federal government will subside and all of this pent up cash and resources will go to work.

While I'm not sure anyone knows exactly when we will see the explosive growth we should expect to see rebounding from a deep recession, clearly conditions are very good to see a push forward and it appears the stock market is perceiving a favorable environment for future growth. Good thing because the world needs it.

Despite my best efforts to look for silver linings, my blogs tend to feel negative, because I generally disagree with the policies and philosophies being implemented (higher taxes, Obama-care, etc...). However, I wanted to spend some time pointing out very positive signs for our economic prospects to highlight hopes of better economic times around the corner:

1) Interest Rates will remain low. Low interest rates encourage investment and spending which is a major plus to economic growth, but also tends to induce inflation which of course can be an economic nightmare. You may think the Federal Reserve pushing interest rates to virtually zero for three years and counting would trigger inflation...

However, as you can see below, inflation has been quite tame (anything below 0.25% for core CPI is ok):

Further, as many of you probably have experienced, wage inflation is very low, meaning that production costs remain cheap and that transfers to lower prices for goods and services.

Wage inflation is low for a bad reason, unemployment is horribly high, but the flip side is that due to high unemployment we have a long way to improve before we start to feel wage inflation in our products and services.

Finally, the rest of world is in really bad shape financially, and are reacting by printing money to boost exports and bailout governments. When they devalue their currency thru money printing our currency's relative value rises, and that stronger dollar translates into cheaper imports which tamps down inflation further.

All of this to say that inflation is low and appears to be capable of staying low for the foreseeable future, and thus borrowing and spending have room to expand.

2) Oil/Gas Production is Booming. Thanks to shale oil we are hitting oil production levels not seen since the early '90s.

Further, Natural gas production is up 20% over the last 5 years:

Both of these things have the effects of keeping energy costs lower for both homes and businesses, but also have the added benefits of both raising GDP, creating jobs, and even lowering government defecits through high tax revenues.

3) Savings is on the rise. While the federal government has been burning through dollars at a record pace. Companies, Families and Local Governments have been cutting the fat and saving money. Personal savings rates are at mid-90s levels and corporate cash is at all time highs:

Source: nerdwallet.com

Remember savings is just future spending and thus more savings from these entities will allow for more economic activity down the line.

My point to all of this, low interest rates, increasing oil production, higher savings levels all point to strong support for a good economic growth. We still have massive headwinds with the looming health care law, the reckless inability of the federal government to shrink long term entitlement spending, and states and municipalities like California, Illinois, and Detroit all deteriorating under the weight of their spending obligations (there's that negativity). However, we also have taken tax uncertainty off the table and have begun to ever so slightly cut federal spending with the Sequester. So possibly some of the the uncertainty created by the federal government will subside and all of this pent up cash and resources will go to work.

While I'm not sure anyone knows exactly when we will see the explosive growth we should expect to see rebounding from a deep recession, clearly conditions are very good to see a push forward and it appears the stock market is perceiving a favorable environment for future growth. Good thing because the world needs it.

2 comments:

Hi Andy,

Glad to see that you are seeing some of the benefits of Obama's policies. Remember all the nay-sayers threatening that Obama was going to ruin capitalism with his socialist (and occasionally fascist even though that doesn't make sense when used in the same sentence) policies? Anyway, we don't have to go there. Let's see how the Sequester affects the job market in the upcoming months. I suspect it is going to hurt our recovery. I think right now is a terrible time for cuts; maybe in a year or two but not now. I’m curious to see the data in the near future.

Hey Brian, I'm certain you didn't read from my blog that I see benefits to Obama's policies. A lot of my optimism is predicated on the fact that the economy has been abysmal under Obama and thus people, companies, and local governments have learned to live lean and now have room to grow.

I would LOVE to hear what specific policies you think Obama has implemented that are good for the economy. I can think of none (except maybe the Sequester).

I will agree that the tax hikes, stupid as they were, actually were very good in the sense that you locked in forever the lower Bush tax rates for 98% of the population and gave individuals certainty.

Post a Comment